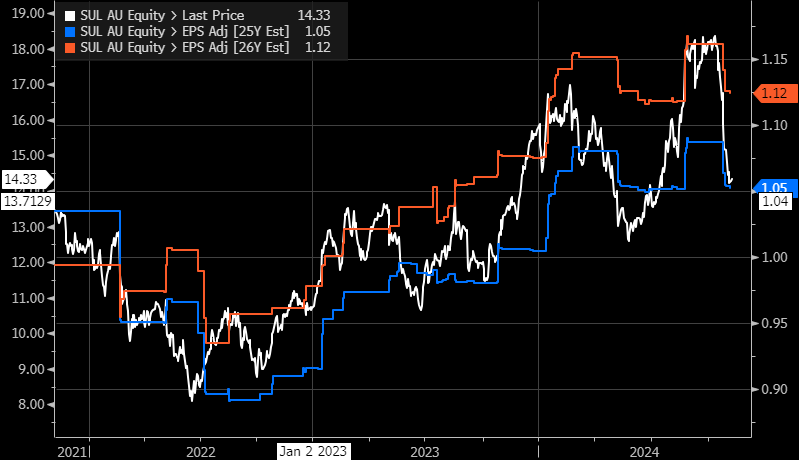

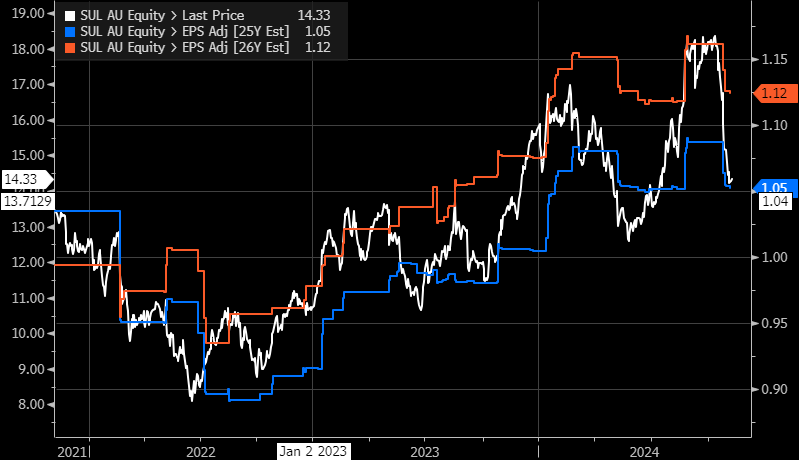

SUL has been in an earnings upgrade cycle since September 2022, with FY25 consensus earnings per share (EPS) estimates moving from 89c to $1.09 by September of 2024. Earnings moving higher justifies a higher PE and the stock price moved from ~$8 to above $18. At their last update they flagged a deceleration in sales momentum which resulted in minor consensus downgrades for FY25 earnings estimates, with the market now expecting EPS of $1.05, equating to a 3.7% reduction from $1.09 prior.

The concern from a markets perspective now is whether this is the start of a more engrained trend where earnings will consistently come down. We’re not seeing evidence (yet) that would imply SUL earnings have peaked. In the upgrade cycle from 2022 there has been several times where earnings expectations dip before the trend continues.

From a valuation perspective SUL has now come back about average, trading on 13.3x having been on 16x before the update. While not excessively cheap, we think SUL is screening solid value around $14 and we remain holders in the Active Income Portfolio, albeit slightly frustrated that we did not exit the position ~$18 when we became more cautious on the stock.