SUL is one position held in the MM portfolios which has been under pressure in 2025, with the stock down 16.2% year-to-date, worse than the broad markets’ 4.9% decline. Most of this underperformance came in February after a disappointing trading update driven by softness in Super Cheap Auto, their largest business, due to stern competition. Conversely, Rebel was supportive and delivered a better-than-expected result. The competition side of things led to today’s decision to revisit SUL after UK retail giant Frasers announced an aggressive plan to take on Rebel in Australia with 100 Sports Direct Stores – to put things into perspective, Frasers is about twice the size of SUL.

- Frasers will spend over $60 million to increase its stake in Accent (AX1), which owns Hype DC and Platypus stores.

- Funds from the AX1 deal will be used to open at least 50 Sports Direct stores in Australia and New Zealand over the next six years, and the group ultimately plans to have a network of 100.

UK-based JD Sports (JD LN) has enjoyed success in Australia, as seen by its busy stores in the malls where we shop; the tills seem much quieter in Platypus stores—there’s room for improvement for AX1. Rebel’s revenue declined to $1.29bn last year, and while it does not publicly disclose the exact percentage of its revenue explicitly derived from footwear sales, it is meaningful. However, at the moment, we feel JD and Platypus are more direct competitors as opposed to the larger, more diversified Rebel.

Sports Direct is a very different proposition. It is known for its competitive pricing, offering daily deals with significant discounts off the recommended retail price. A quick look at its website, Sports Direct does remind us very much of the Rebel offering and as we all increasingly shop with our fingers on keyboards, if they compete aggressively both online and in the forthcoming stores, it will pressure Rebel’s margins to some degree – how much is the million dollar question. The good thing for Rebel and SUL is it will take time, 50 stores over 6 years is not a sprint and will give SUL time to batten down the hatches.

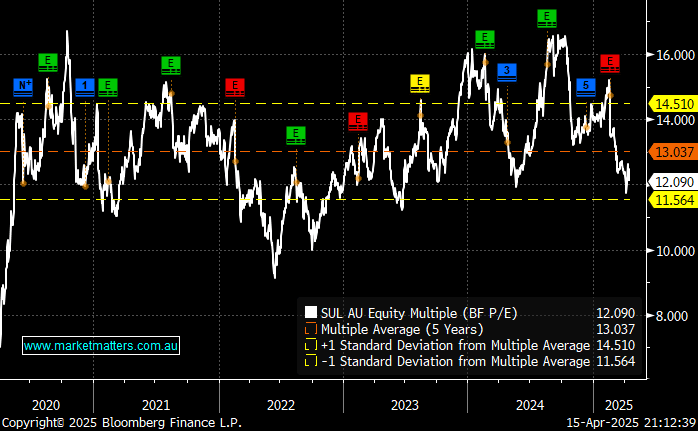

- From a valuation perspective, SUL is trading on the “cheap side” after the February numbers, but it was discounted further back in 2022 when the market was trading back around 6500. Assuming we are correct, the global economy doesn’t fall into a recession, and the RBA cuts rates into Christmas, SUL should be well supported by its more than 6% fully franked yield over the coming 12 months.

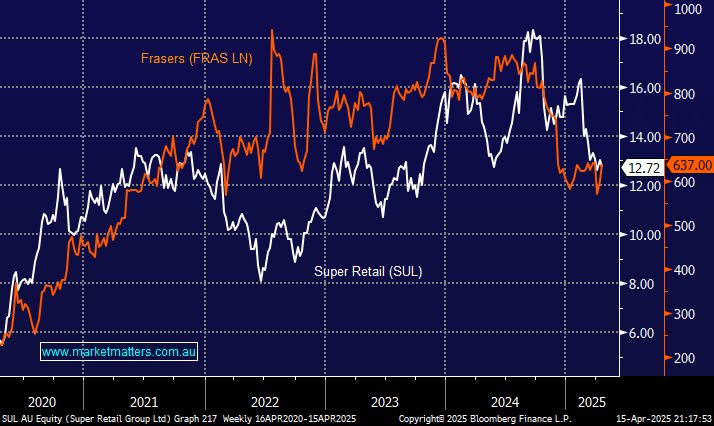

Interestingly, retailers SUL and FRAS have trod a similar path over recent years, with recession concerns recently weighing on the space. While it is easy to argue that JB Hi-Fi is a better-quality retailer, it remains expensive; in our opinion, at this stage, we are comfortable with our SUL position, but we will be watching moves by Frasers with keen interest.

- We remain bullish on SUL over the coming years. MM holds SUL in both our Active Income and Active Growth Portfolios.