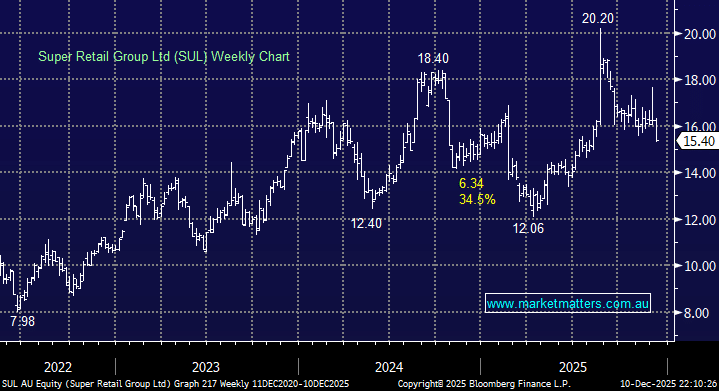

SUL has struggled since the board sacked CEO Anthony Heraghty in September after admitting his disclosures about a relationship with senior executive Jane Kelly – not a billionaire behaving badly, but the impact was similar. The stock is now over 20% below its highs scaled after its strong FY25 result and FY26 trading update. The business generates healthy free cash flow, leaving room for further special dividends, although the company played down the prospect – forecasts are for a yield of 4.3% over the coming year, assuming no special dividend which they have delivered in recent years. Super Retail is highly sensitive to consumer spending, with its brands Supercheap Auto, Rebel, BCF, and Macpac, relying heavily on non-essential purchases.

From a valuation perspective, SUL is still around about average, which in an expensive market is okay, plus they reported well at their last update.

- We like SUL as a business, but it looks unlikely to outperform the sector over the coming months – we are currently long in two of MM’s portfolios.