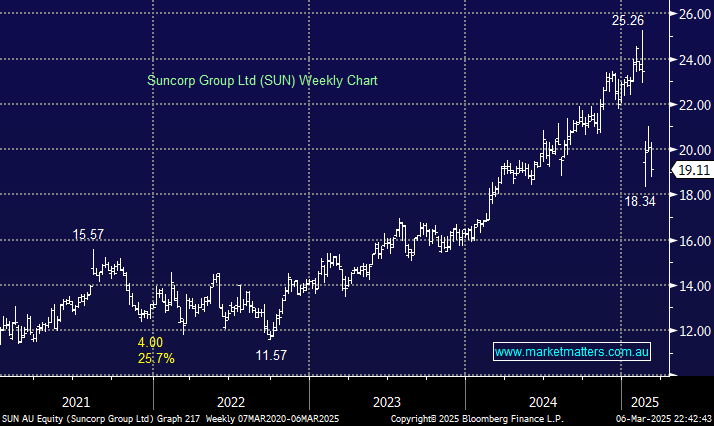

SUN has evolved into a pure insurance business this year after finalising the sale of its banking arm to ANZ. They delivered a strong result in February, with earnings ~11% ahead of consensus courtesy of lower claims, the elephant in the room for insurers, and not to be repeated in 2025 as Alfred rolls into the mainland. However, reinsurance will limit the damage to SUN, i.e. they’ve offset their risk exposure to large-scale natural disasters:

- Suncorp maintains an MER (maximum event retention) of $350 million for the first large event and $250 million for the second large event. This means SUN will cover losses up to these amounts before reinsurance coverage applies.

There will be no bumper-low claims for SUN in 2025, but there is a potential medium-term buying opportunity. We continue to like SUN, but from a valuation and growth perspective, around 6% lower. The burgeoning cost of living has caused a trend of Australians either forgoing insurance or being underinsured across various sectors, including property and health insurance. However, in most cases, people have no choice, leaving SUN well-positioned as premiums rise to offset claims and maintain margins.