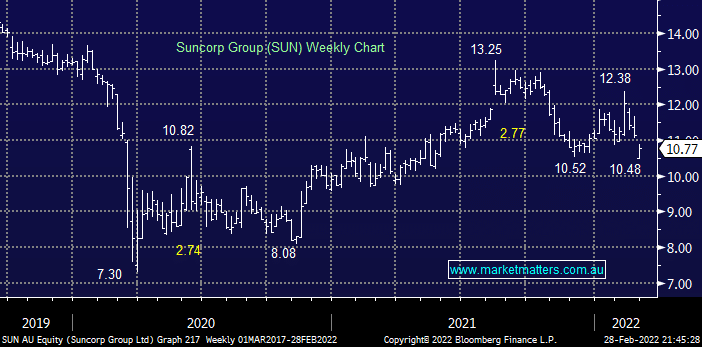

SUN gaped lower yesterday after the insurer said the current floods would cost the Queensland based insurer a maximum of $75m due to comprehensive reinsurance plans. Not too bad in our opinion considering they’ve already received over 5,000 claims due to the horrendous weather conditions that are now Sydney bound and importantly the company said its full year outlook for natural hazards remained unchanged. Following its 20% correction over the last 6-months we feel SUN has become a viable alternative to the banks on the ASX.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM likes SUN into weakness below $11

Add To Hit List

Related Q&A

The Performance of Suncorp (SUN)

ANZ purchase of Suncorp

Thoughts on SUN

Q&A -weekend report – SUN

Q&A -weekend report – DRO & SUN

Thoughts on Suncorp (SUN) please

ANZ’s Suncorp Take Over

Thoughts on the ANZ / SUN potential sale

Dates on Suncorp divestment to ANZ please

What is MM’s current view on Suncorp (SUN)?

Does MM like SUN after its strong rally?

What are MM’s thoughts on the ANZ – SUN tie up?

Banks & / or insurers as rates rise?

Semi Conductors

How do you get the yield on the SUNPI?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.