Strandline announced it will proceed with the development of the Coburn mineral sands project in WA after reaching a final investment decision yesterday. The project is expected to average $104m EBITDA per year for the initial ~23 years of mine life. While this is clearly reliant on prevailing mineral sands pricing that assumption uses a conservative discount to current spot. The project is shaping up to be an Iluka-like business, just without the huge iron ore royalties it coaxed from BHP. The mine build is fully funded – $100m in cheap debt from Northern Australia Infrastructure Facility (NAIF), $80m bond issue and the remainder coming from cash raised at recent capital raisings. First production is scheduled in the second half of 2022 with 95% of the first 5 years of production covered by offtake agreements.

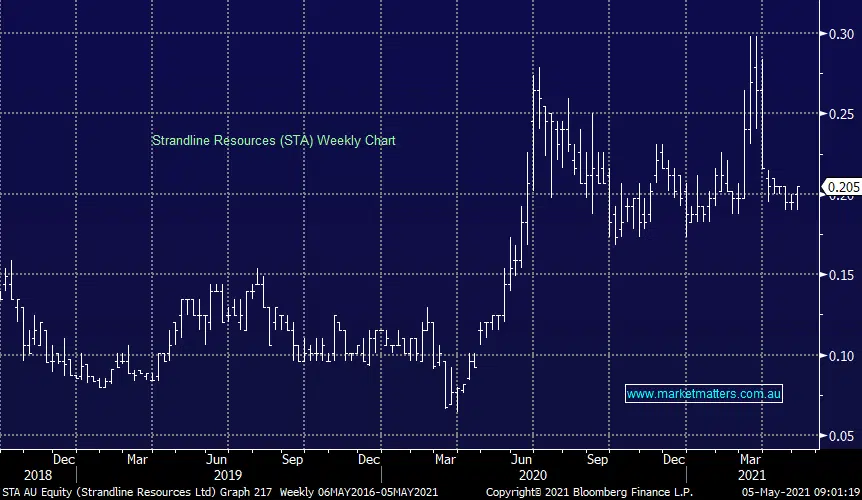

The share price has been under pressure of late, with any buying tapping out at the 20.5c raise price over the last 4 weeks. While it’s great news that they will proceed with the mine, a mine build does have complexity / risks– cost blow outs and delays have seen the end of many mid-cap miners in the past so equity takes on a decent risk to see (in this case) next 12-18 months through. At ~20c we see the risk vs reward in favour of the holders given it should see 9c EBITDA/sh in full flight, while they also own an exploration asset in Tanzania they are yet to scratch the surface on.