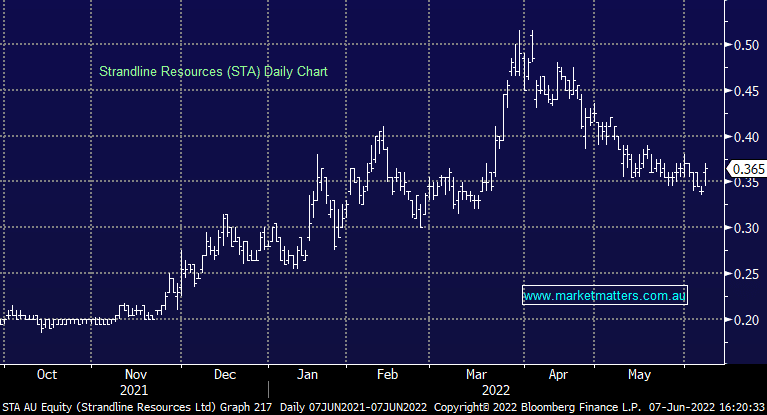

STA +7.35%: another positive progress update for the junior mineral sands hopeful puts them on track for production before the end of the year. With their Coburn project in WA, Strandline are hoping to capitalize on strong mineral sands prices that are currently running around 35% higher than the feasibility study had priced in. On track and on budget is the message from the company and we expect shares to track higher given cashflow is now months away.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

James on Ausbiz this morning talking markets

James on Ausbiz this morning talking markets

Close

Close

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is bullish and long STA in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Does MM have any news around STA?

When should we buy Strandline (STA)?

Thoughts on Strandline (STA) please?

Thoughts on Capitol Health, Austal and Standline Resources?

Does MM like Strandline (STA)?

Does MM prefer Iluka (ILU) over LYC &/or STA?

Q&A for Sat Weekend report – STA and ETPMAG

Update on Standline (STA)

MM thoughts on STA & ORE

Relevant suggested news and content from the site

chart

James on Ausbiz this morning talking markets

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.