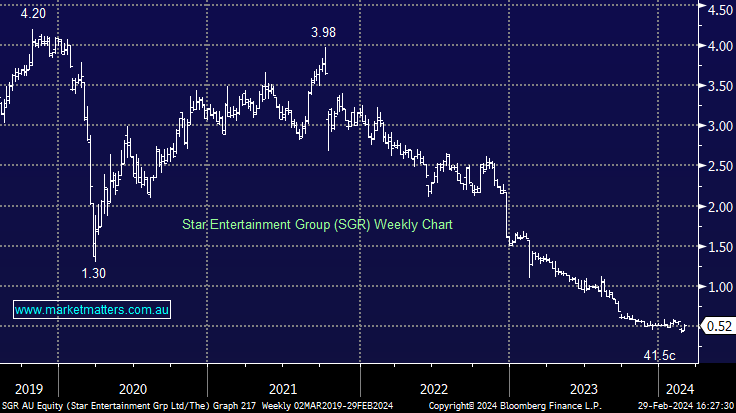

SGR +8.33%: the casino operator delayed their HY result given the recent announcement of a second review into the Sydney casino from the NSW Casino regulator. The company was aiming for ~$20m EBITDA per month at the AGM in August, coming in slightly below that run rate with $114m in the first half. They blamed additional gameplay controls as well as increased competition from Crown and other pubs and clubs for much of the weakness in Revenue, down -15% on 1H23. Star said EBITDA in January was in line with the $20m target, however, there tends to be a slowdown into the back end of the financial year as spending slows which likely means downgrades to consensus for FY24. Despite that, shares were higher today given some extremely bearish expectations heading into the print.

- We see plenty of value in SGR’s assets, however, unlocking it is a complicated task given the regulatory backdrop.