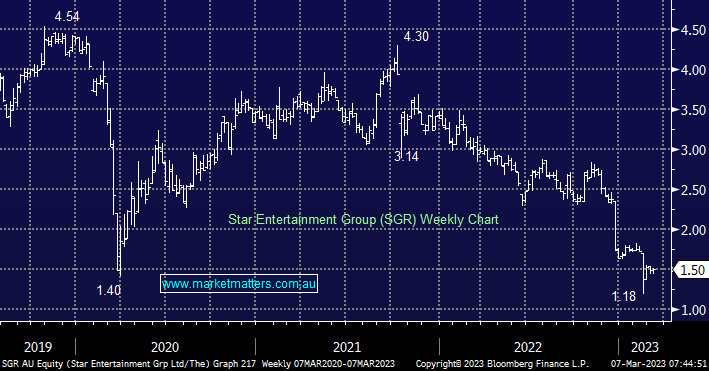

SGR has experienced an awful year which has led to the $1.6bn casino operator being forced to raise $800mn at $1.20 per share but we shouldn’t forget that Blackstone took over Crown Resorts (CWN) when it was also struggling. This stock comes with enormous political risks/baggage but there is the logic for a well-respected casino operator who wants a footprint in Australia to consider SGR, alternatively, they could take a decent stake in the business and wait to see what plays out on the regulatory front.

- We aren’t fans of the business/stock but it was worth a mention today because stocks do bottom out when things look there worst e.g. InvoCare (IVC).