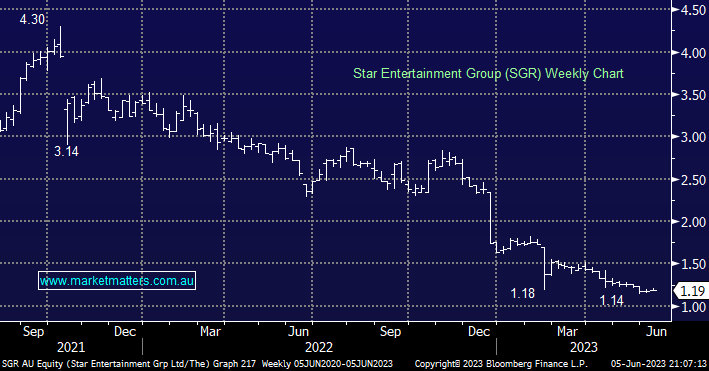

SGR has regularly been in the headlines this year as the stock tumbles ever lower, yesterday we heard that its Brisbane Queens Wharf project has again been delayed. The $3.6bn resort was due to open before Christmas but now April 2024 is the new date – until we get close perhaps! This is a joint venture with SGR holding 50% and the other two 25% blocks domiciled in Hong Kong. Moving forward the expectation is SGR will receive a hefty fine from the financial crimes watchdog plus the NSW casino tax is likely to increase but we believe this is largely built into the share price. Importantly the NSW Government is better placed to receive significant revenue from SGR as opposed to putting them out of business – a sceptical but pragmatic view.

- We believe the next 25% for SGR is far more likely on the upside providing excellent risk/reward for the brave/aggressive investor.