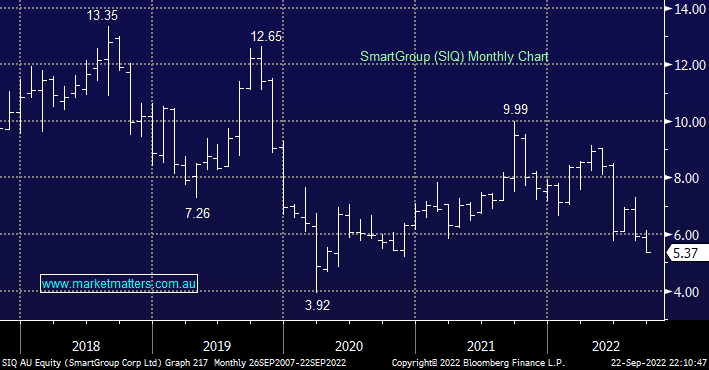

SIQ is a $718mn Sydney-based Australian salary packaging & novated leasing company. This has been another story of a failed takeover offer which originally came in at $10.35 before being reduced and then failing. The stock has continued to struggle since its half-year results delivered in August which saw revenue of ~$114mn and NPAT of almost $31mn, up 16% year on year, however their guidance implied flat earnings for the year ahead, we wonder if the currently depressed share price will appeal to suitors now.

- We took a reasonable profit from SIQ in our Active Income Portfolio back in July, it may find itself back on the menu ~$5.