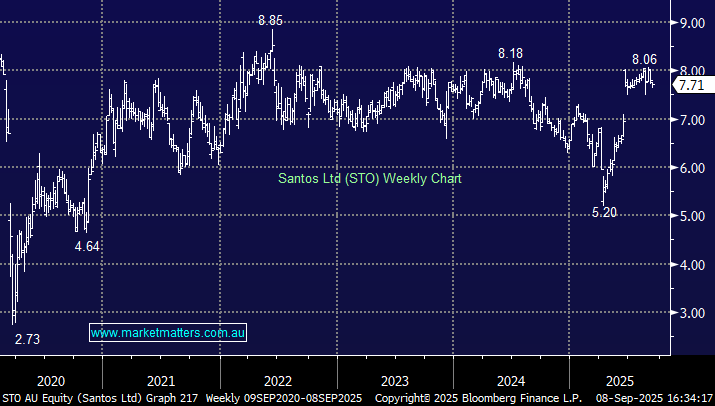

STO is currently “in play” following a bid from a consortium led by Abu Dhabi’s National Oil Company (ADNOC) and private equity firm Carlyle, the non-binding all-cash offer of $8.89 per share, which values STO Santos at approximately $30 billion, a 15% premium to yesterdays close. Santos’ board has granted the consortium exclusive due diligence access and has agreed to extend the exclusivity period for ten more days. The transaction will proceed only if due diligence, a binding scheme implementation agreement, and all necessary regulatory approvals are secured, the stock trading well under the bid suggests the market is skeptical.

STO is trading well below the bid price due to political, regulatory and timing risks plus underlying sector fragility. Its hard to know if the bid will succeed but the markets not confident, however the stock looks good value to MM in the $7-7.50 region, a point which ADNOC clearly agrees with.

- We like the risk/reward towards STO on dips back towards $7.50.