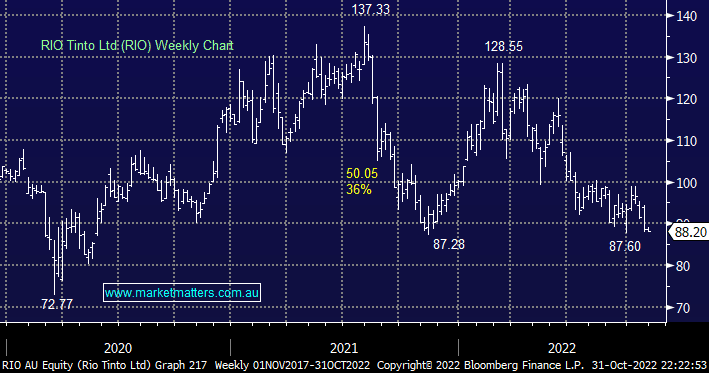

RIO has followed a similar path to FMG with a test below $80 feeling a strong possibility over the coming months. Since their ill-fated blast of an ancient aboriginal site in early 2020, RIO has rightly attracted all the wrong headlines and with the importance of ESG considerations for large institutional investors (and many private ones), it is not surprising that RIO has drifted off many investors’ radars.

Obviously, Chinese demand for iron ore needs to improve before RIO will look attractive again, but they also need to deliver from an ESG perspective and given this overhang, we have a preference for Fortescue (FMG) as a pure play in the sector.

- We believe RIO is starting to present value but we prefer FMG.