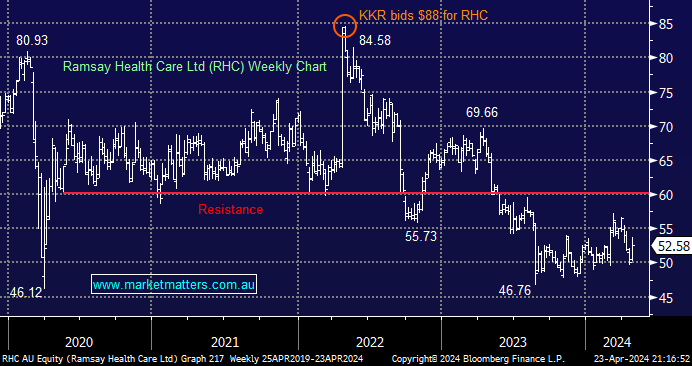

RHC rallied the most in seven weeks on Tuesday as strong buying saw volume increase to 55% above its average of the last 20 days, with 83% of all trades occurring at the offer, i.e. there was a buyer on the prowl. We believe the stocks offering value for investors prepared to look through its French debacle, the position that derailed the bid by KKR at $88 in 2022! Management got a 1 out of 10 regarding its foray into France and how it dealt with KKR’s bid, which should have been grabbed with both hands.

The French Government has hurt the private hospital operators again without any formal announcement; the Health Minister indicated on 27 March 2024 that the latest round of tariff increases for the 2024/25 year would be 4.3% for the public and not-for-profit hospital sector and 0.3% for the private hospital sector – a drop from 5.4% in the previous year. Operating in France is difficult at best as the playing field becomes increasingly uneven, the public hospital sector, despite its inefficiencies, remains protected, enjoying tariffs ~25% more than in the private sector for exactly the same procedure, whilst commanding 75-80% of the volume

- RHC, unfortunately, owns 52.79% of Ramsay Generale de Sante, which, with a market cap of EUR1.4bn, is a far smaller company than $12.1bn RHC.

- Good investors cut their losses, we question if the RHC Board will reconsider its options on Ramsay Sante, especially while it is performing a portfolio review of its assets.

We were happy with Ramsay’s 1H update, which demonstrated plenty of improvement in the UK/Euro business, which has been a major area of concern, while the Australian business remained solid. 1H sales were +7.8% year-on-year, and the company continues to expect mid-single-digit revenue growth for FY24, as well as expansion of NPAT. Also, FY25 margin in Australia is expected to rise despite peak IT project spending. This is a stock that’s gone from being loved to unloved in a few years; at current levels, we can see some fund managers reconsidering their position, which might account for yesterday’s pick up in volume.

- On its conference call, management reiterated that they are conducting strategic business review activities to try to unlock value and improve performance.

- We do not expect the company to announce anything structurally substantial in the near future, but at least intent appears to be there.

The main risks associated with RHC relate to government regulatory changes which impact private health participation or funding, and adverse currency movements for its overseas operations.

- We aren’t enamoured with our entry into RHC, but we believe the private hospital operator represents good value around $52 – MM holds RHC in our Active Growth Portfolio.