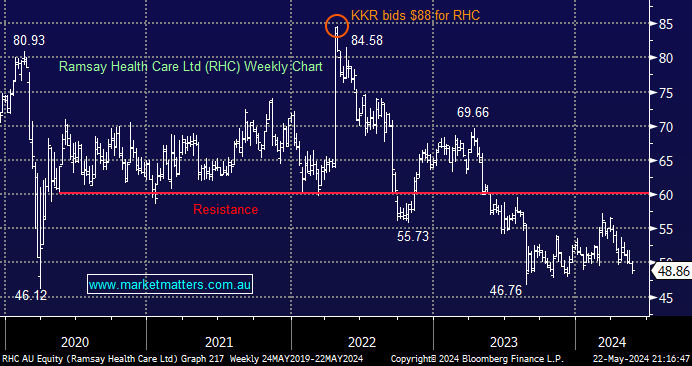

RHC has been a thorn in our side for more than a year, and the turnaround we’ve been looking for is still not materialising. Fortunately, we purchased RHC after it had fallen ~20% from its KKR bid high, but it’s still not a pretty entry of $68.86. We discussed RHC in detail last month and its frustrating exposure to Ramsay Générale de Sante (GDS FP), which has recently been hamstrung by a French government that doesn’t like private healthcare. We liked the company’s recent 1H update, but it often takes more than one positive piece of news to be removed from the “naughty corner”.

We’re not privy to KKR’s valuation calculation, but if it believed RHC was worth buying at $88 in 2022, it’s hard not to imagine it being attractive sub-$50. Either that or the private equity operator dodged a proverbial bullet.

- We like RHC into current weakness and, as previously flagged, will consider averaging our position into “panic” style selling.

- Our current thinking is that RHC will rotate between $45 and $60 over the coming 12 months, and we will invest accordingly