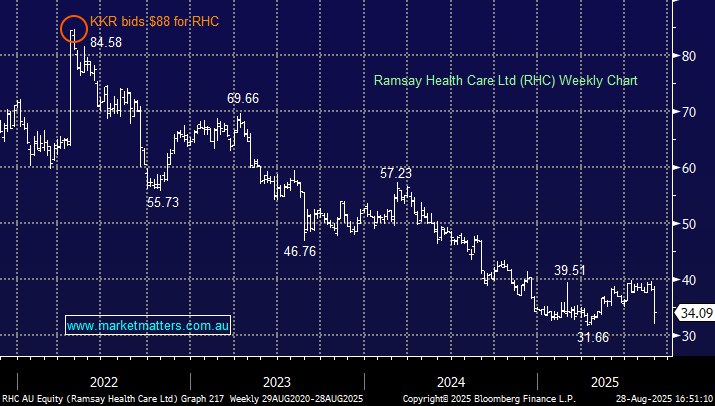

RHC -10.5%: Different day, same result for RHC as shares plunged with the stock down more than 12% early in the session. The country’s largest private hospital operator disappointed investors with weaker-than-expected margins from its Australian business.

- Revenue of $US177.7mn was in line with expectations.

- NPAT came in at $24mn, down 97% YoY.

- EBITDA of $2.16bn was +1.6% YoY.

- A 40c dividend was announced, the same as last year

RHC’s Ramsay MD Natalie Davis said the company was taking “decisive action” to improve returns and had made good headway on its transformation plans but the market has a short-term memory. The stock remains unpopular with only 2 buys on it out of the 17 analysts who cover stock.