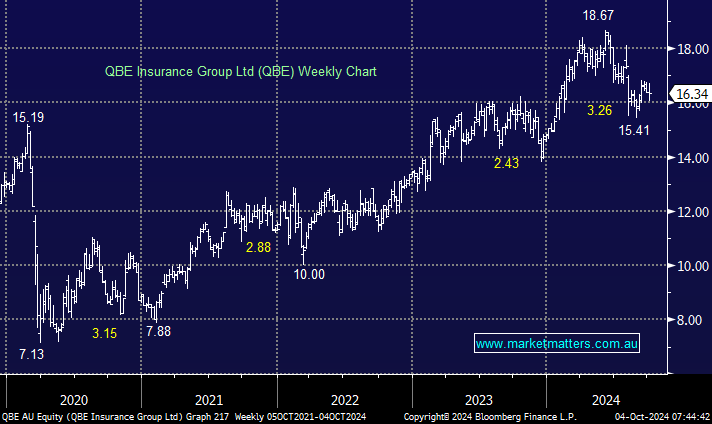

QBE has been under pressure in recent months as the prospect of falling interest rates weighs on the stock. Although it’s still up 10% year-to-date, it’s corrected over 17% from its June high. QBE’s recent 1H24 result was broadly in line with expectations, and we like the current chapter as the insurer gets its house in order. Plus, it’s still too cheap due to its messy history, and its valuation is well below its global peers, a factor which we believe will dissipate with every solid report.

- We believe the negativity creeping into QBE around interest rates is getting ahead of itself whether Trump wins or not.

- A Trump victory is likely to reduce the number of Fed rate cuts in 2025, which is bullish for QBE. Plus, we already believe the anticipated path of cuts is already “as good as it gets.”

NB MM has added QBE Insurance (QBE) to its “Hitlist” in our Active Growth Portfolio.