Rex Airlines has entered voluntary administration; the local, regional player has 60% of the market for regional carriers outside of Qantas and Virgin, servicing more than 50 small destinations. This will rapidly become a political football with next year’s election looming. In 2023, Transport Minister Catherine King dismissed an application by Qatar Airways to add extra capacity to help Australian inbound tourism recover without any real explanation or reference to policy principles. We all had to wear higher airfares for our holidays to protect Alan Joyce and QANTAS; now we ponder how they will react to the REX news.

Prime Minister Anthony Albanese and Transport Minister Catherine King said they were watching closely to ensure Rex does not go under after low-cost carrier Bonza’s recent collapse. Still, they declined to pledge federal funds for a bailout. Mr Albanese told the ABC on Tuesday that Rex already received subsidies, while opposition spokesman Simon Birmingham sided against costly taxpayer-funded rescues. But Rex connects many regional centres, hence its importance to regional voters before an election. Treasurer Jim Chalmers said the Rex situation was “a concerning development because we want there to be good regional airlines, and we want people to be able to move easily and cheaply around regional Australia.”

- Politicians are weighing into the REX issue ahead of next year’s election, expected before May, but the time for action has arrived—“watching closely” will not achieve anything.

Singaporean businessman Lim Kim Hai is said to control more than 50% of REX’s shares, which hasn’t helped operations since he was recently ousted. Mr Lim wants to be reinstated as chairman at a September 6 vote and told The Australian Financial Review on Monday that “it will be in the best interest of the company.”

- Politics and ego are a dreadful combination. Over the coming weeks/months, people will blame Virgin and QANTAS, but REX clearly has made plenty of its own mistakes.

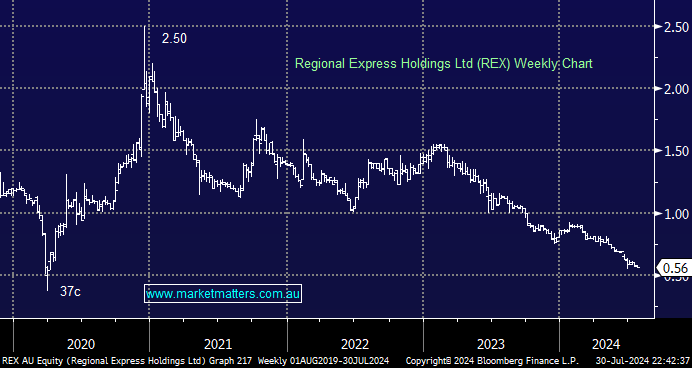

- We believe REX will survive in some restructured form, but it will require delicate negotiations and, most likely, money.

QAN shares rose 1.6% on Tuesday, with the obvious initial read-through being less competition, which equals reduced pressure on pricing. However, it’s not all good news, with REX likely to rise in some restructured form, potentially with government assistance. After last year’s protectionist move towards Qatar Airlines by the Albanese government, it would only be fair to the taxpayer if QAN was made to run the less profitable/loss-making routes. However, we’re confident that won’t eventuate. The benefit that QAN will enjoy from REX’s removed pricing pressure would be more than offset by filling the regional void if REX were to vanish for both tourism and industry.

Overall, we believe QAN must be evaluated without consideration of REX, which is unlikely to have a meaningful impact on its earnings, due to be reported on August 29th. The lack of a 3Q trading update combined with QAN continuing to buy back shares up until year-end suggests earnings are on track to meet expectations. QAN has bought back ~$1bn worth of stock over the year, with another $300m share buyback likely to be announced in next month’s result. Plus, Australia’s flagship airline is on track to start fully franked dividends in FY25.

Local domestic fares are down -4% over the last year but are expected to turn positive in coming months while International fares continue to decline substantially, although the market is stabilising with Qantas International fares down -9%. Not a great backdrop for QAN, but it’s ridden the move well and is positioned strongly for the next cycle.

- We are mildly bullish towards QAN ultimately looking for a retest of the $7 area.