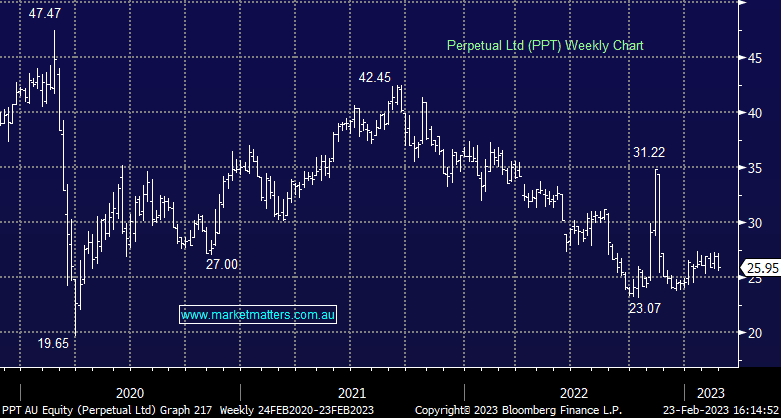

PPT -2.81%: While the result was inline in terms of underlying profit, the composition of earnings were weaker, particularly in the prized Trust business where costs were higher. While these were offset by lower costs in Perpetual investments, it seems like cost growth is tracking along at a higher rate overall than the ~6% they guided to. They kept the expected synergies derived from the acquisition of Pendal unchanged at $60m pre-tax while the 90cps dividend announced today included the 35cps special that was paid earlier in the month. They maintained a targeted 60-90% payout ratio and suggested the final dividend payout is likely to be ~75%. All said and done, we expected more upbeat commentary regarding PDL, which we didn’t get + the elevated costs in the Trust business is not ideal.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

We were planning to increase our small weighting in the stock (Income Portfolio), but we’ll hold fire for now

Add To Hit List

Related Q&A

Perpetual Ltd (PPT)

Perpetual Ltd (PPT)

GARY stocks

Perpetual Limited

Your view on several stocks

Analysis of WHC, BHP, and PPT please

Your comments on some stocks please

Fund Managers

MM should be helping Magellan (MFG)!

Can you explain the PPT/PDL pricing please?

Thoughts now on PPT and PDL

Thoughts on PPL’s takeover of PDL?

Why is Pendal (PDL) falling after PPT’s bid?

Is it a good time to consider any of the fund manager companies?

What does MM think of Perpetual (PPT)?

Targets for PPT, CPU & CSL

MMs view on MOC & PPT

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.