In November last year, a consortium led by the Regal Partners (RPL) launched a takeover bid for Perpetual (PPT), who themselves were attempting a takeover of Pendal (PDL). Regal was ultimately unsuccessful with their tilt, however, we think it’s worthwhile revisiting how they thought about the value in the PPT business, and how relevant it is now, in as simple terms as possible.

The consortium bid $1.7bn for Perpetual which equated to $30 per share. PPT said it materially undervalued them despite being a 23% premium to their 30-day average. There was also a curve ball thrown by a legal opinion that related to the potential size of break fees paid to Pendal if Perpetual pulled out – and that in itself may have scuttled the move. Ultimately, the deal completed and Perpetual took over Pendal. However, as part of the Regal bid, they had lined up the sale of the corporate trust business for $1.4bn providing a solid look-through value for that division, which is the largest provider of corporate trustee services and transaction support in the country, with Funds Under Administration (FUA) of $1.16 trillion. So, based on that number, around 50% of the current group’s value is underpinned by the $1.4bn value for the trust business.

That leaves the funds & wealth business, and we’ll focus on the former which is where the value is. The funds business has over $200bn of FUM, about 5x the amount of Magellan (MFG) and is around 40% more than GQG Partners (GQG) which is capped at around $4.1bn. Regal Partners (RPL) themselves are capped at $935m and have $5.5bn in FUM, although they are an alternative asset manager, so charge more.

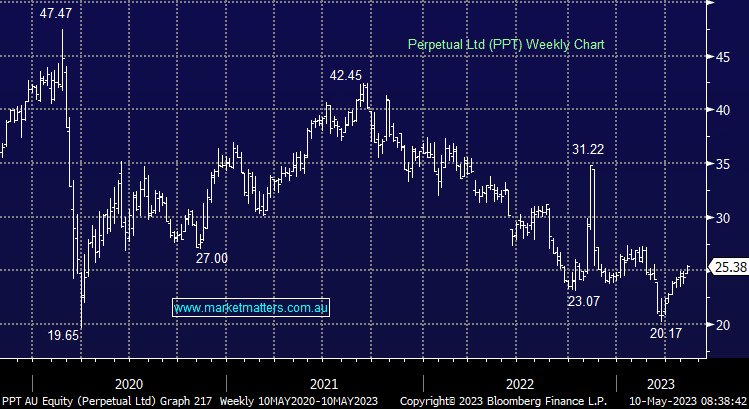

- Clearly, Regal thought Perpetual was cheap before they took out Pendal, and we think that’s still the case now. In MM’s view, PPT is worth well north of $30, or 15-20% higher.