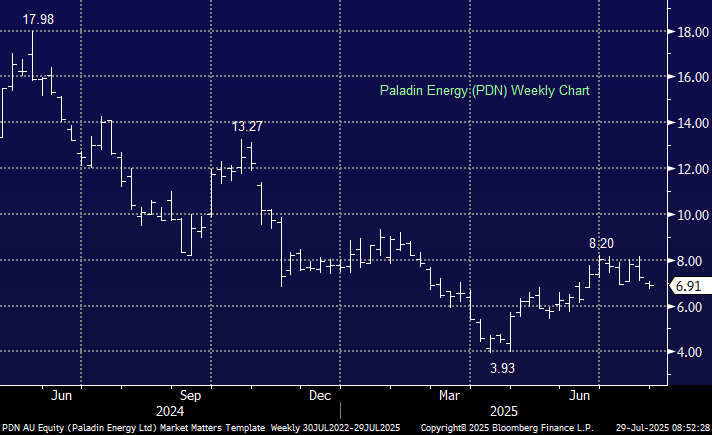

PDN was hit hard last week on lower-than-expected FY26 guidance, and yesterday’s BOE shocker extended the pullback to almost 18% in five trading days. We believe the pullback is overcooked on the downside, allowing investors/traders to re-enter if they missed the more than 100% rally from its April low. However, we are conscious that it’s in a downtrend, increasing the risks of playing the stock from the “long side.”

- We like the risk/reward towards PDN around $7, initially targeting a break of the recent $8.20 high.

Note, Shawn’s Trading Ideas went long PDN yesterday at $6.80, with stops at $6.45, ~ a 5% risk. With the current volatility, this is likely to be a quick trade one way or another!