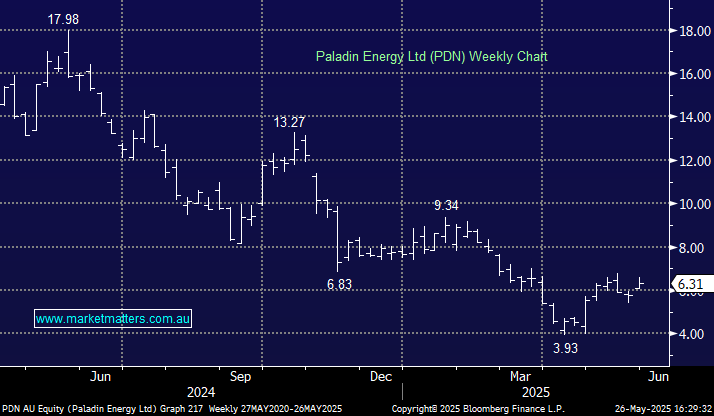

Monday saw the Australian uranium miners latch onto Trumps very bullish rhetoric towards nuclear energy, as he looks to accelerate the construction of nuclear power plants. At MM, we’ve steadfastly stuck with our positive outlook towards the uranium sector, which has paid off with our international holdings, but local names have endured a shocking year.

The ASX uranium stocks have been battered, and they are heavily shorted. If prices continue to rise, a short squeeze is a strong possibility; the top three ASX200 stocks on Monday were all major uranium stocks, and they happen to be three of the seven most shorted stocks on the main board. PDN is the second most shorted stock, and after their improved Q3 trading update and now some better macro news, we struggle to see the short thesis. We discussed increasing/averaging our positions yesterday, though we’ll sit pat for now but with a bullish bias.

- We continue to believe PDN is undervalued and can see it initially testing $9 in the coming months, another 30-40% higher: MM is long PDN in our Active Growth and Emerging Companies Portfolios.