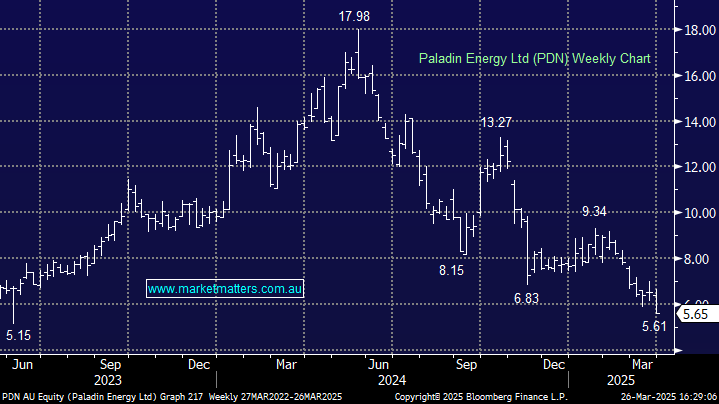

PDN –11.58%: Released more detail around the extreme weather event impacting operations at their Langer-Heinrich uranium facility. The rains are now being called a 1-in-50 year event and as a result production guidance for FY25 has been withdrawn.

Access to the site due to damaged roads and saturation of ore stockpiles will have an effect on near-term production whilst the partial flooding of the open pit mine will delay the mine ramp up. Management emphasised flooding is a simple fix via water pumps, though acknowledged it will cause delays to production.

The ramp up of mining operations in the second half of the year was critical to reaching the targeted 6Mlb pa target with the higher grade mined ore to complement the lower grade tailings/stockpiles. FY25 earnings are expected to decline 2%, with the back half of CY25 and FY26 likely to see larger downgrades given that was when ramp up was set to peak.

- Whilst the weather isn’t something management can control, we are becoming increasingly cautious toward PDN given these operational issues are almost a quarterly occurrence.