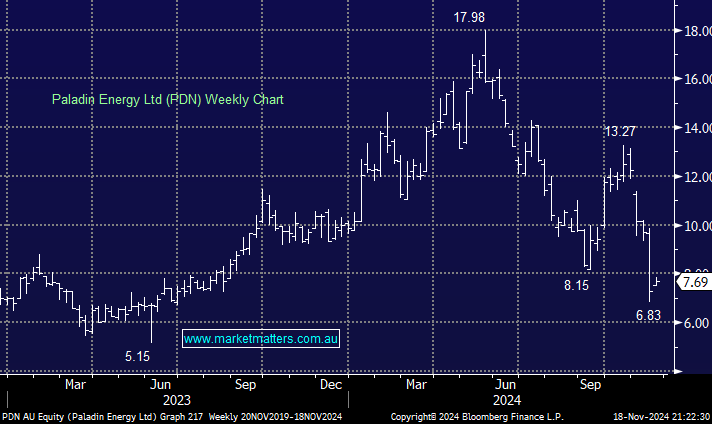

PDN bounced +5.5% on Monday, but it remained significantly below its May peak. The Paladin share price has plunged ~48% in the past month due to commissioning issues at the Langer Heinrich Uranium mine. We believe this has been a massive overreaction. PDN’s market capitalisation has fallen by ~$1.5bn in the past month, a massive hit, relative to the value lost implied by the downgrade – circa ~A$60m. The Paladin share price is now lower than when uranium was only US$50/lb; today, it’s over $US80 and headed toward ~$US100, in our opinion.

Paladin finished the September quarter with US$55m in cash and US$55m available in undrawn loans. Despite the downgrades, PDN is expected to be free cash flow positive in the December quarter. On last week’s management call, CFO Anna Sudlow confirmed that Paladin does not need additional funding for the completion of recommissioning the mine.

- We think PDN is extremely cheap, below $8, but it’s not for the fainthearted – MM owns PDN in its Active Growth and Emerging Companies Portfolios.