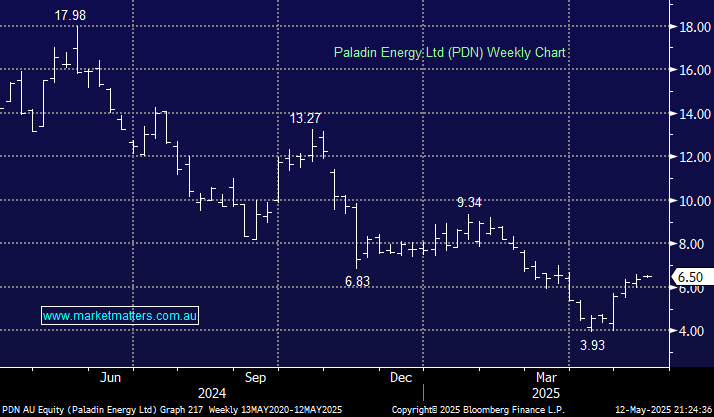

PDN has struggled operationally over the last year, but it delivered better performance in their Q3 update; we can see the miner beating expectations and producing ~2.8 million lbs of uranium in FY25. With the stock priced to miss this, this could propel the stock significantly higher. The uranium producer has been a frustrating position for MM, but its +65% bounce over the last few weeks is very encouraging. While it might need a rest in the $6.50-7 range, we will advocate buying dips until further notice.

- We believe PDN screens well at current levels and can see it initially testing $9 in the coming months, another 30-40% higher: MM is long PDN across two portfolios.