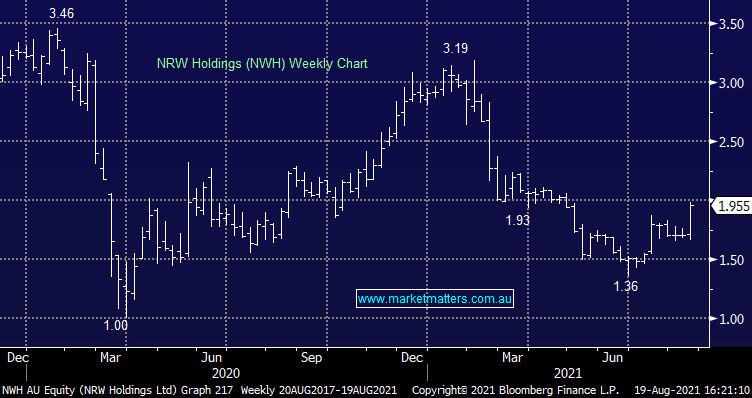

FY21 Result: An in line result for NWH on FY21 with EBITDA at $266.7m, right on consensus expectations. Guidance was the standout though with EBIT for FY22 expected to be in the range of $145m-$155m vs market expectations at $147m. The company talked up their large order book and importantly, they sighted improving margins which was the key, plying cost pressures that have been a hindrance are starting to ease. Shares rallied 17.42% today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bullish and long NWH

Add To Hit List

Related Q&A

Buy/Hold/Sell

Profit Taking

Valuations

Should we ride NRW Holdings?

NRW Holdings (NWH) after a great AGM

What stocks would we top up here?

MM’s view on NWH

Why don’t we use stop losses?

Thoughts on NRW

Our view on NRW Holdings & Monadelphous Group (MND)

Why is NRW Holdings falling?

NRW Holdings (NWH)

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.