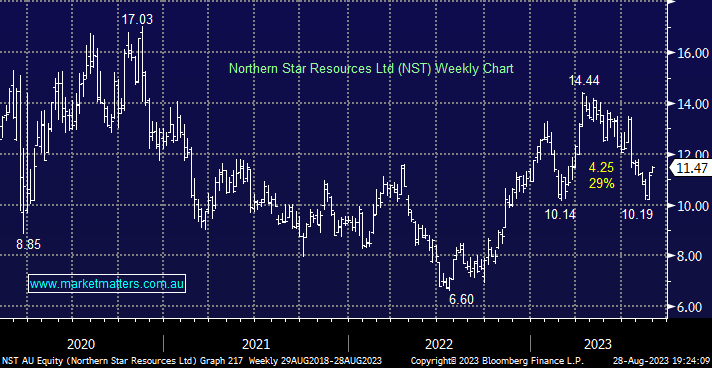

Last week we switched our 5% Newcrest (NCM) position into NST, a move we’ve been flagging for many weeks following the takeover bid for NCM by Newmont (NEM US). The trigger for the move was NST’s solid earnings numbers this month, the miner reported a +9% increase in revenue allowing the miner to pay a 15.5c dividend in September plus extend its buyback for an additional 12-months.

- We now prefer NST over NCM following the latter’s outperformance post the takeover bid – we now hold a 5% NST weighting in our Flagship Growth Portfolio.