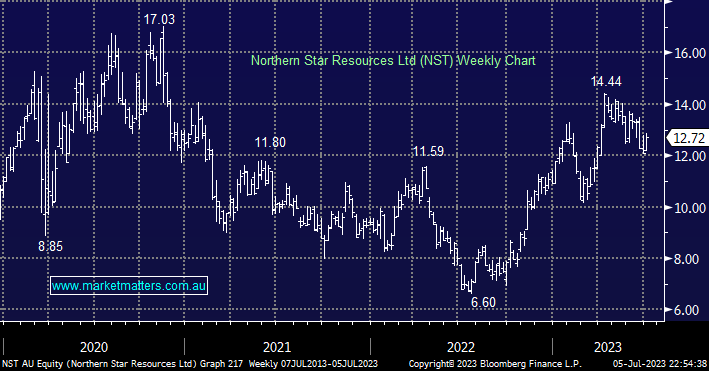

In line with most of the local sector, NST has corrected -17% from its May high, taking it back to the middle of its last 3-year trading range even while gold in $A terms powers towards new highs i.e. the sectors not in vogue due to rising interest rates. In our opinion, NST is basically a direct gold play as each rise of +US$100/oz gold increases our valuation of NST by $1 and vice versa e.g. if gold rallies back toward $US2,200 then NST should be testing $16.

- We are likely to switch our NCM holding into NST at an opportune time from a respective price differential perspective.