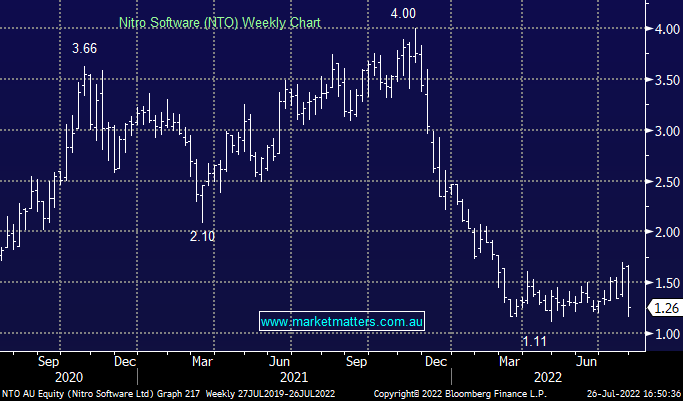

NTO -22.7%: the signature and document productivity business was hit hard following their 2Q update today. Annualized Recurring Revenue (ARR) ended the period at $US51.5m, up 11% in the period, largely driven by an increase in services offered to existing clients. The company noted that sales cycles had lengthened, another way of saying new clients have been hesitant to spend money to integrate Nitro’s software. As a result, the company downgraded ARR guidance from $US64-68m to $US57-60m, an 11% cut, with the market particularly concerned with the reduction in expected revenue synergies from the Connective acquisition from $US2.5m to just $US1m. They did maintain revenue guidance, and improved operating EBITDA loss expectations by 30% to $US10-13m on the back of $US5m in planned cost savings to come through in the second half.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is reviewing its NTO position after a poor update

Add To Hit List

Related Q&A

What are MM’s thoughts towards Nitro Software (NTO)?

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Is it time to take tweak some positions?

Thoughts on Pointsbet & Nitro?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.