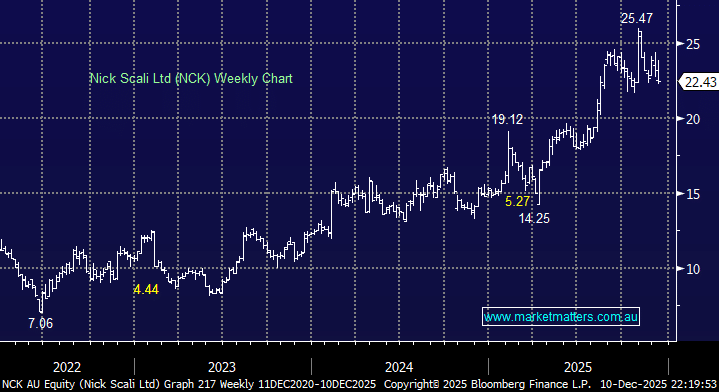

NCK has been a standout performer both on the ASX and for MM in 2025 – it’s up +49% year-to-date while many of its peers have struggled. The stock made new highs in October following its AGM, as the company continues to execute impressively. They’re measured international expansion through Fabb Furniture in the UK is playing out nicely and could become a playbook for many ASX names looking to take the often fraught leap into overseas markets. We remain big fans of this business.

From a valuation perspective, trading on 22x is on the expensive side for now, however near-term earnings are being weighed down by losses in the UK which will turn into profits in the coming years, driving higher earnings growth and lower valuation.

- While near term sentiment is on the weaker side for the retail sector, which may drag NCK back towards $21, we believe this is a stock to remain patiently long, regarding weakness as a buying opportunity – we hold NCK in our emerging company’s portfolio.