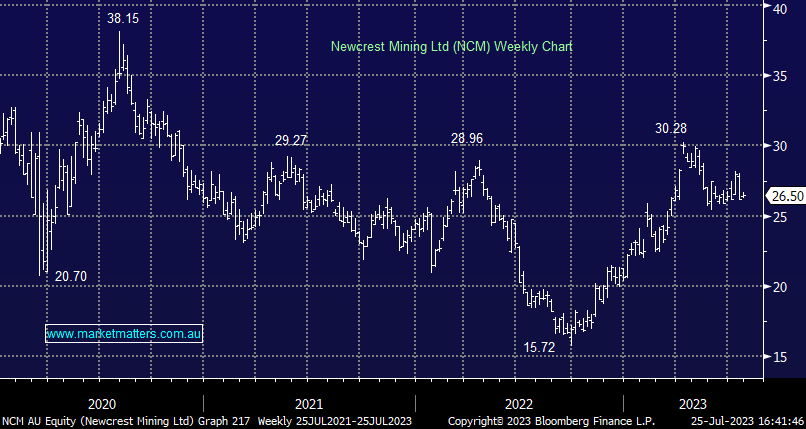

NCM +0.08%: NCM reported June quarter production numbers this morning that were on the weaker side, the bid from Newmont (NEM US) looks to be somewhat of a get-out-of-jail-free card here. They produced 556koz gold in the period, ~4% below expectations which put upward pressure on costs, with an AISC of US$1,196/oz up ~US$200/oz q/q. The numbers mean they just scrapped into the low end of their FY23 gold production guidance while they just missed on copper. Importantly, the NEM deal is on track for completion before Christmas with the bid worth $27.85 per NCM as of today’s close. Continuing to hold NCM requires a view of NEM – to that end, NEM retained CY23 guidance of 5.7-6.3moz despite the June Quarter being disappointing. NCM will report FY23 results on Aug-11 and they provide FY24 guidance at that time.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains long NCM

Add To Hit List

Related Q&A

How can we get the Newcrest (NCM) dividend?

Why does MM regard the “Newmont CDI” as annoying?

NEM take over of NCM

NCM

Thoughts on the 2nd tier gold shares please

How much upside does MM see in the likes of EVN?

Does MM like Gold Stocks For Income?

Does MM still like Gold around all time highs?

If Newmont’s bid for NCM is successful how do I cash in?

Does MM prefer NST or EVN at current levels?

Does MM prefer coal over gold as inflation settles?

Thoughts on NCM, WOS and NAB please?

GOLD

This weeks Commodities Webinar

Our technical view on Gold

Regis Resources (RRL) – thoughts post raise

OGC

WPL vs BPT, NCM vs OZL

Thoughts on gold here

MM thoughts on gold

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.