NSR owns storage facilities across Australia, positioning it perfectly for the structural transition we see unfolding over the coming years. The stock is forecast to consistently yield ~4.7% over the coming years, which will be especially attractive if the RBA starts cutting interest rates next year, as is widely expected. The company is due to report on Friday, which may have led to some short-term nervousness in the stock.

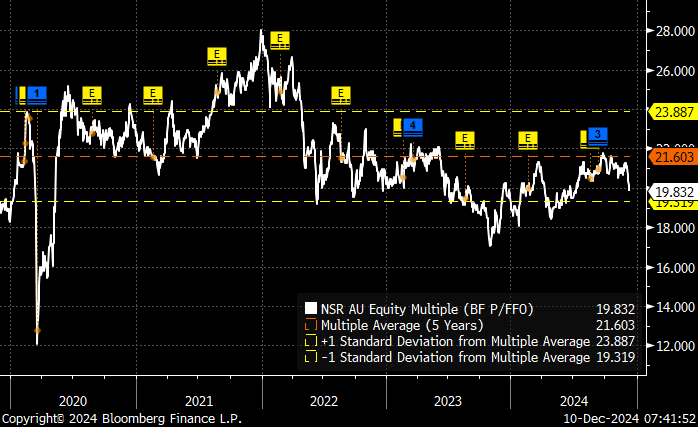

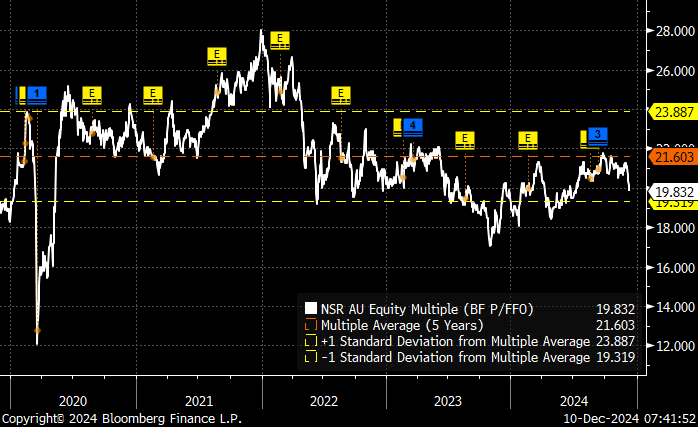

- Unlike much of the ASX, NSR is trading on the cheaper side of history, and importantly, we expect mid-single digit earnings growth over the next 3-years which will underpin consistent growth in dividends in that time frame.

This might not be an exciting play with the stock treading water over the last few years, but we shouldn’t forget that in early 2020, NSR was in a takeover tussle between New York-listed storage giant Public Storage and Hong Kong Gaw Capital, a company that would be familiar with high-density living. At some point, we believe NSR will be in the cross-hairs again.

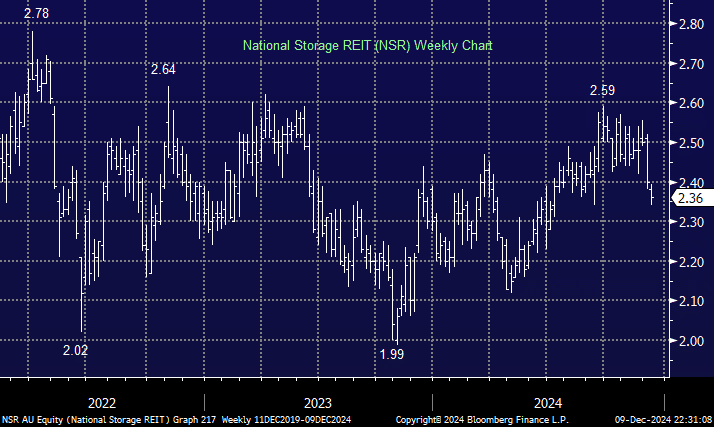

- We can see NSR testing $3 over the coming years.