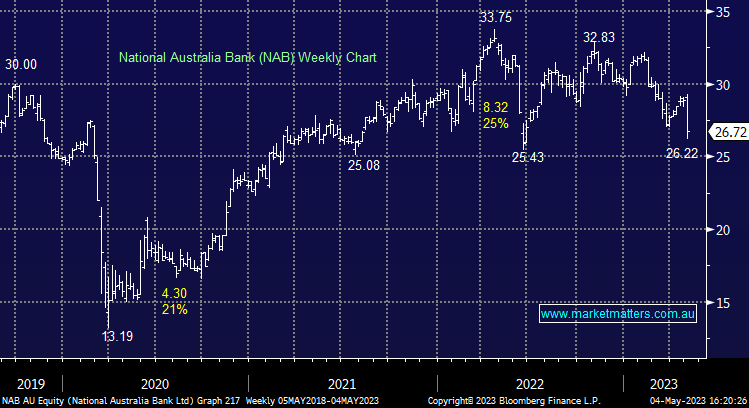

NAB -6.41%: While we thought the stock would trade lower, we were surprised at the level of weakness given the composition of the underlying 1H23 result that was a record in terms of earnings, but showed a soft underbelly in terms of margins which will likely impact the 2H. 1H23 Cash earnings of $4.07bn were up 17% however that compared to $4.18bn expected (-2.6% miss) thanks to a NIM of 1.77% versus 1.83% expected. Cash Diluted EPS from continuing operations was 124.3cps while the Interim dividend of 83cps fully franked was below the 86cps expected (some were even higher). While margins are expanding (+0.14%) due to higher interest rates, some of the benefit is being eroded by competition for mortgages and deposits, importantly, it seems margins peaked in December at 1.79% and have tracked lower since, with the 2Q exit margin at 1.76%. As CEO Ross McEwan said today, “It’s very difficult in the mortgage market at the moment, very, very competitive, margins getting knocked around there.” Asset quality and capital levels remain very strong, NAB saying that 90-day arrears reduced by 0.9% to just 0.66% driven by improvement in home lending, although they did say arrears in their business lending had increased.

- Expect earnings downgrades to flow here, with the 2H more challenging than the first, declining margins and an uptick in delinquencies a poor combo!