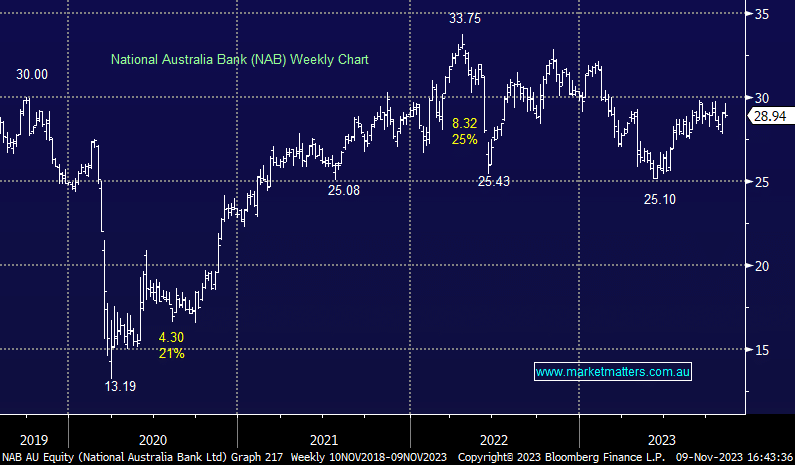

NAB -0.79%: the second major bank to report FY23 numbers this period, NAB shares underperformed today on a slight miss. Cash Profit was up 9% to $7.73b, slightly below estimates of $7.8b, mostly on lower markets income rather than the core result. Net Interest Margin (NIM) fell 6bps in the 2H to 171bps, though this was as expected. As were higher costs on wages, inflation and a higher depreciation and amortization charge. Credit quality remains solid with Bad and Doubtful Debts (BDD) around ~10% below expectations and although mortgage arrears were higher, Non-Performing Loans (NPL) remain resilient. The bank said competition for mortgages and deposits remains fierce which is expected to keep NIMs low for now, however, they are confident Australia will avoid a significant downturn, which would support earnings – talking their own book! NAB will pay an 84cps final dividend, once again in line with expectations.

- NAB’s FY23 result was largely as expected, we continue to have a preference for ANZ & NAB in the Big 4, with CBA for income