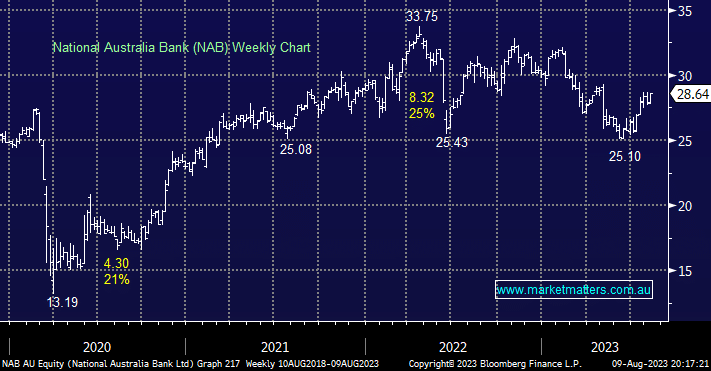

NAB jumped on CBA’s coattails yesterday closing up +2.2% on Wednesday, it doesn’t report until November however CBA commentary yesterday implied resilience and even strength in business banking which provided a good read-through for NAB, while size and scale are also important.

National Bank is currently forecast to yield 6.15% fully franked over the coming 12 months i.e. the markets understandably tagging NAB as a higher risk/higher reward play than CBA. We are conscious that NAB is trading at 1.62x book Value which is above its long-term historical average, hence reaffirming our general view to buy dips in the banks as opposed to chase strength but we continue to like Australia’s 2nd largest lender over the medium term.

- We hold NAB in both our Flagship Growth and Active Income Portfolios.