NAB rallied another +1.1% on Monday, taking its gain for the month to +3.55%, a strong performance considering the index is slightly lower year-to-date. Markets are looking for 1-2 years of rate cuts, which is usually a tougher environment for the Banking Sector, but the “Big Four” remain firm, with CBA posting fresh highs almost daily and the worst performer still up +3.15% so far in January. As we often say, don’t fight the tape, and the Australian banks remain strong with their attractive, sustainable yields and increasingly less concerning bad debts enough to keep investors on the buy side.

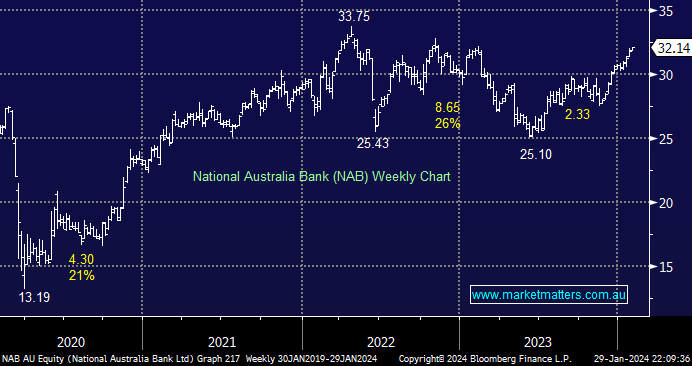

- We can see NAB breaking its 2022 high before entering another period of consolidation – a bullish short-term read-through for the ASX.

- The risk/reward doesn’t favour chasing NAB above $32, but we have no plans to take profit on our NAB holdings in our Active Growth and Active Income Portfolios.