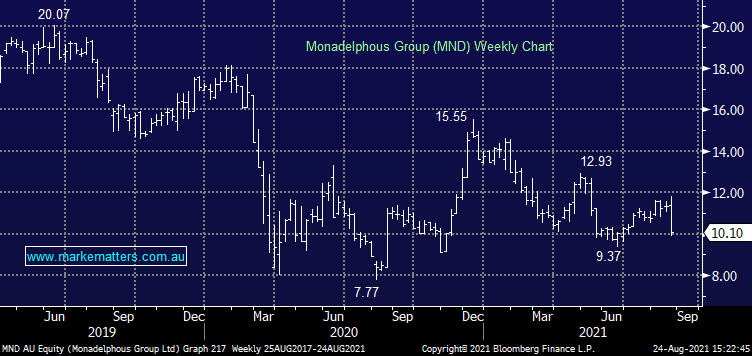

FY21 Results: MND reported revenue of $1.95bn which is ~6% above expectations however profitability was a miss given margin issues, NPAT of $47.1m was a ~13% miss to consensus. The FY21 DPS of $0.45 was inline while guidance is now for lower revenue in FY22 – the market is positioned for a similar level. They talked to ongoing skill shortages with a review of their attraction & retention practices i.e. more money to keep good talent. We had NRW Holdings (NWH) report last week and rally ~20% on signs of better margins however MND have not enjoyed the same fate today. It’s clear that winning work is not the issue, fulfilling it is.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM now has MND under review

Add To Hit List

Related Q&A

Buy, Hold, Sell – CWY, MVF

Reporting update on 3 stocks- CRN, CAJ and MVF

Why did MM choose WOR over MND?

When a stock is not marked ‘Active’

Our view on NRW Holdings & Monadelphous Group (MND)

MM stance on Monadelphous (MND)

Monadelphous Group (MND)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.