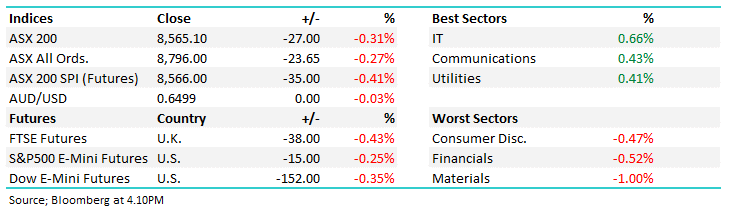

MIN-20.72%: The gift that keeps on giving, with MinRes reporting 1H25 financial results that were a slight beat to downbeat expectations driven by Mining Services, however, lower Iron Ore guidance from Onslow Iron plus an additional $300 million needed to upgrade the haul road as a consequence of tropical cyclone Sean saw the shares trade sharply lower.

MIN have now made the decision to fully asphalt the 150km haul road after water damage means capital expenditure for FY25 is now $2.1 billion versus consensus of less than $2 billion at a time when debt is a major concern.

- Revenue of $2.29 billion down -8.9% yoy, ahead of expectations for $2.21 billion.

- Underlying Ebitda $302 million, -55% yoy, versus consensus of $200.8 million

- Net loss of $807 million driven largely by non-cash impairment charges.

Today’s conference call (@ midday AEST) was the first chance for direct questions to Chris Ellison in the past 6-months, which caused some frustration in itself, with most focus on the haul road issues, what they got wrong there, the balance sheet with net debt at $5.1bn and upcoming maturities, related party transactions and the prospect they may need to raise cash under a new Chairman. All of these aspects were answered, some with a straight bat, others with a degree of spin, however the overarching issue is the market has lost confidence at a time when net debt to EBITDA sits at a challenging 7.4x. The markets confidence that MinRes under Chris Ellison will just get sh*t done has vanished.

There is clearly frustration, which is showing up in the share price, however, we came off the call with some semblance of confidence that now is not the time to fall on our sword, and while hindsight says we should have taken our medicine sooner, selling into what we think is an overreaction to today’s update will only compound the issue.

- Our focus with this position is identifying when we should be reweighting up to our target, given the decline in the shares has reduced the active weight. We will send an alert at that time.