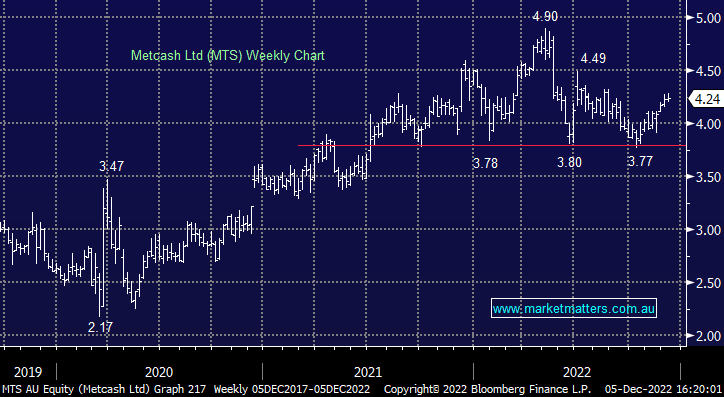

MTS +0.24%: Released 1H23 results this morning that were ahead of expectations led by Hardware & Food. They also pointed to a strong start to 2H23 so all seems to be rosy for MTS. Sales of $8.9bn was +7.8% y/y while underlying EBIT of $255.1m was +10.3% y/y, & around 6% ahead of market expectations. The 11.5cps dividend was also a beat. We own Metcash due to 1. Relative valuation trading on 14x forward while yielding 5.5% FF 2. The trend of greater localisation to drive earnings in food & liquor & 3. Their faster-growing hardware division becoming a big influence on the group leading to higher earnings + a greater rate of growth in earnings = justifying a higher multiple on those earnings.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish & long MTS

Add To Hit List

In these Portfolios

Related Q&A

A Quick Metcash Query

AFR’s comments re Metcash

Metcash (MTS)

What would be your entry price for Metcash?

Metcash in the Active Growth Portfolio

Metcash SPP at 8% discount – is it worth it?

Does MM still like Metcash (MTS) after recent falls?

Could you update your views on ABP & MTS

MM’s current views on MTS and semiconductors please

Some thoughts on Metcash (MTS)

Is Metcash (MTS) a buy?

What are GARY stocks?

Understanding the Metcash buy-back

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.