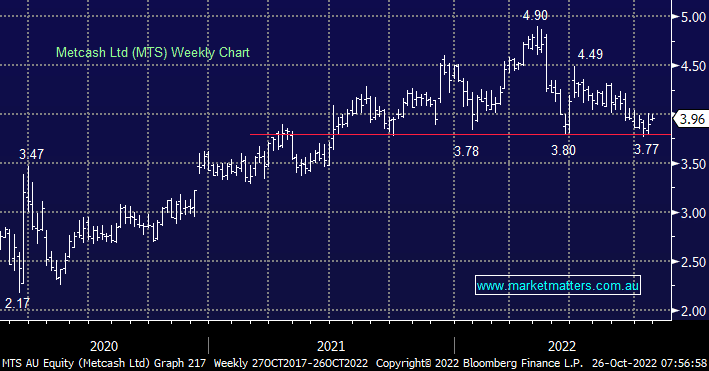

Around $4, we think Metcash should attract yield-hungry investors that pocket the dividend from the banks and look for the next ‘pay-day’. While we have covered the investment thesis on MTS a number of times (available on the company page here), the brief version is:

- we think the stock is undervalued for the growth that is coming from their hardware division.

- MTS reports earnings in December and goes ex-dividend just before Christmas with the consensus dividend expectation sitting at 13c fully franked for the half.

- With ANZ, NAB & WBC going ex-dividend in November, we believe MTS is a very logical place for funds to transition towards.