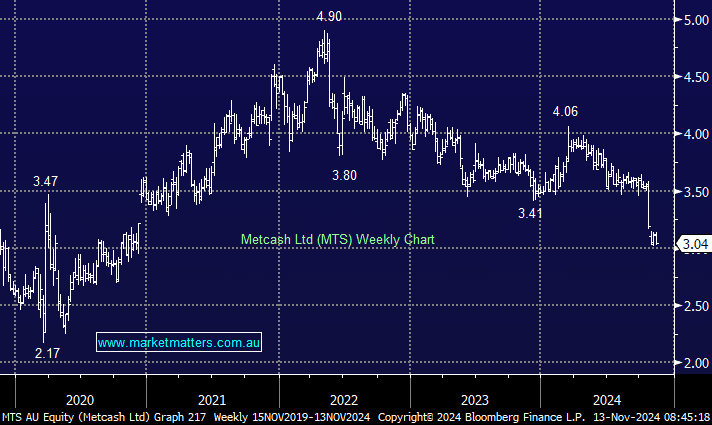

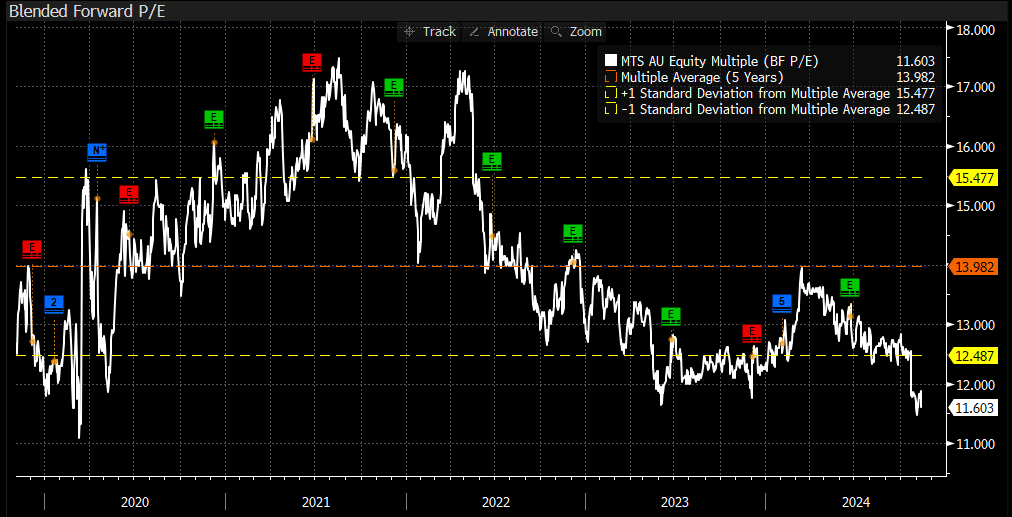

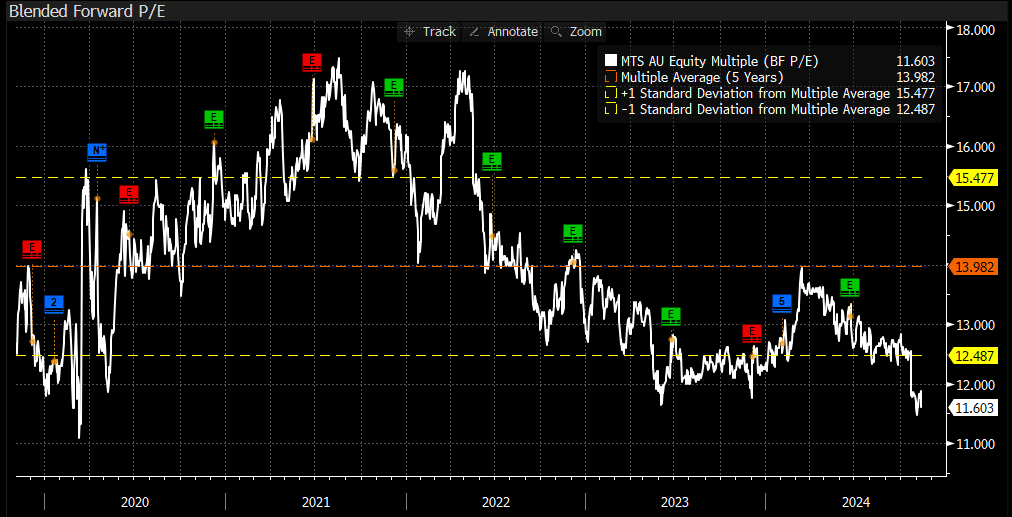

A tough run in the last few months for Metcash, with selling accelerating when Goldman Sachs took a knife to their forecasts and cut the stock to sell, a good call in hindsight ahead of the company downgrading 1H25 earnings guidance towards the end of October. MTS has been a core holding in the Income Portfolio since December of 2020 with the healthy dividends the only contributor to returns. Following the Goldmans downgrade, our view remained that a depressed valuation was already pricing Goldmans concerns (covered here), though that view has clearly been challenged.

Our long-held thesis was that MTS’s expansion in hardware would elevate growth at the group level which would underpin a higher earnings multiple for the stock. The opposite has played out, with hardware under pressure while food has shown resilience. In hardware, trade has been the issue with their Independent Hardware Group (IHG) suffering, while Total Tools has also felt some pressure, though to a lesser extent. Metcash is more reliant on trade than Bunnings, with around 64% of hardware sales for MTS in that area compared to Bunnings at ~34%. DIY is holding up, so Bunnings continues to outperform IHG.

Share prices follow earnings over time, and FY25 will see earnings down around 3% relative to FY24. Not a good trend, but not a disaster. FY26 should be better following the integration of recent acquisitions with consensus currently expecting 9% profit growth, though a lot can play out between now and then. On a forecast 7% fully franked yield and trading on ~11x, there is not a lot of optimism priced into the shares, though we must concede, our original view on MTS and reason for owning the stock has not materialised.

We have gotten MTS wrong, and while our position is up ~15% since inception overall, capital has gone backwards. For MTS to improve, the cycle in hardware needs to turn, and that could be some way off.