META ended down -10.6% overnight, at one stage plunging up to 16% in premarket trading after the Facebook parent forecasted higher expenses and lighter-than-expected revenue in its quarterly result—not a great combination. The issue was all in the guidance, as it actually enjoyed a strong 1Q, with a beat in both the top and bottom lines. Revenue was 1% higher than consensus at $36.46 billion, up 27% year-on-year – the highest year-on-year (YoY) growth since 3Q 2021. Also, Earnings per share (EPS) beat expectations by 9.8%, coming in at $4.71 and up more than two-fold from the $2.20 a year ago. Unfortunately, the market expected more from Meta regarding its forward sales outlook.

The company guided 2Q 2024 total revenue to be ~ $37.8 billion, falling below the $38.3 billion market consensus. This raised concerns about whether we have already seen the peak in growth momentum, with YoY growth potentially falling to 18.1% in 2Q 2024 from the current 27.3%. AI is not always good news; the race among the big tech costs money, with Meta anticipating a $5 billion cost increase from its AI infrastructure investments for 2024 to fend off competition.

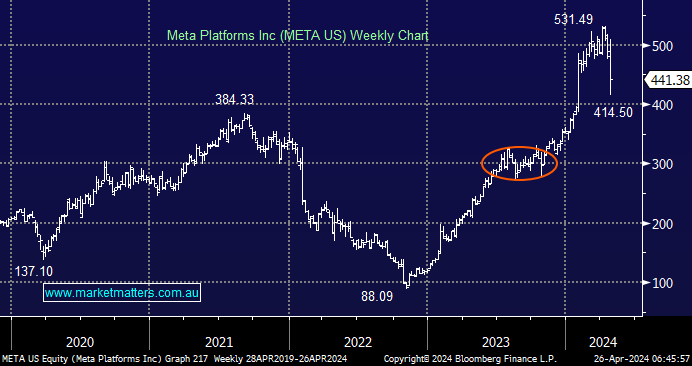

- We like the risk/reward towards META after its 22% correction.