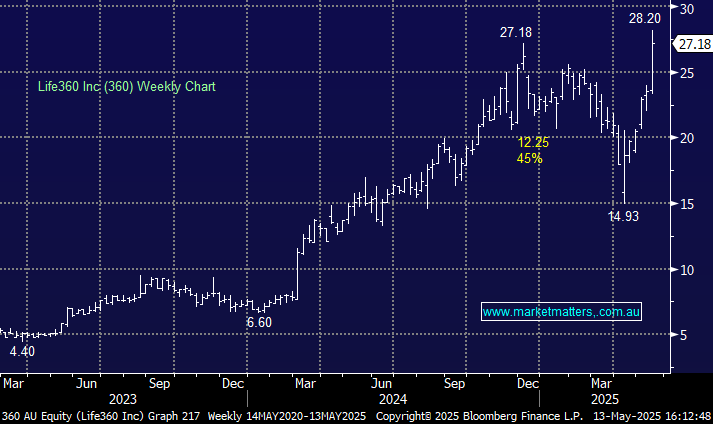

360 +13.96%: jumped today on better-than-expected 1Q25 results with the stock price now having doubled since its ~$14 early April woes.

- Revenue $103.6 million +32% y/y

- Adjusted Ebitda $15.9 million vs. $4.3 million y/y

- Monthly active users 83.7 million, +26% y/y

This marks the 10th consecutive quarter of positive adjusted earnings – the business is showing strong operating leverage with a 23% increase in expenses vs the 32% uplift in revenue enabled by greater subscription retention i.e lower rate of customer churn, which has been a key concern for the company with annual churn over 50% in recent years.

Management has opted to delay the launch of the much-anticipated pet tracking product in the US and proceed elsewhere. This soft launch will mitigate tariff and trade policy risk and test the waters for the uptake of the product in other regions e.g Europe, minimizing costs if it doesn’t take off.