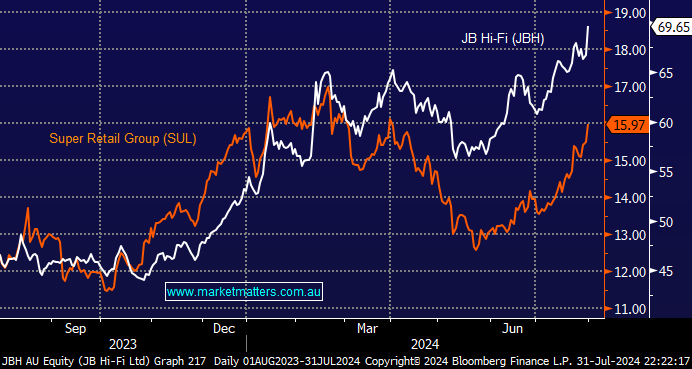

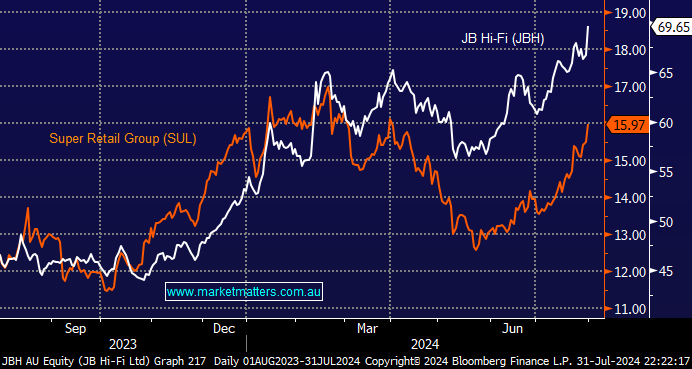

JBH surged +4.3% following yesterday’s CPI as investors focused on rate cuts rather than increases, posting fresh all-time highs just a few days after UBS put out a sell recommendation on the stock! We have been targeting the $70-75 for JBH since we went long into sector selling in May. There are a couple of thoughts here:

- Rate cuts are coming, and we want to maintain our retail exposure through JBH or another favourite Super Retail (SUL).

- The surge in several retail stocks in 2024 has already built in rate cuts while discounting any risks of a deeper economic downturn, the often-referred-to “Goldilocks” scenario.

- Within the sector, we now prefer SUL to JBH from a risk/reward perspective right here, while we like APA, discussed earlier, as a more defensive yield play.

NB On the yield front, JBH is forecast to yield 4.2% over the next 12-months compared to 4.9% by SUL and 7.4% (unfranked) from utility APA.

- We will reconsider our JBH position above $70– MM owns JBH in our Active Growth Portfolio.