The integrated marketing/printing business reported last week and while growth at the top line was solid with revenue of $970m, up +28% from FY22, it was driven by their acquisition of Ovato during the period. Profit was okay, slightly below expectations however it was their outlook for growth that has the market disappointed. It was thought that they would be able to successfully drive better margins through the scale they achieved during FY23, making FY24 a strong year for the company, however, their guidance was weaker than expected.

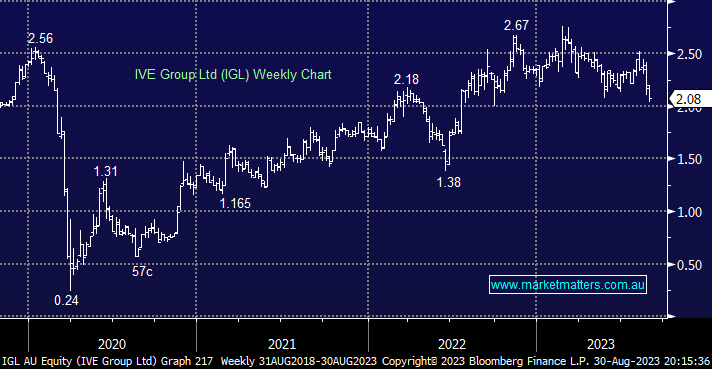

For FY24, they expect net profit after tax (NPAT) of $40-43m versus consensus of $45.3m, which implies only low single-digit growth, while the guidance was over 8% below consensus. As a result, broker downgrades have followed but the likes of UBS and Bell Potter still have targets ~30% higher. We believe the stock is being treated harshly after the result and around $2 it’s looking attractive as a yield play.

- Not a great result but the almost 9% yield around $2 is very tempting – MM has IGL in its Active Income Portfolio Hitlist.