When high-performing funds make major sector switches within their portfolio, we always believe it makes sense to evaluate the move. GQG has basically halved its tech exposure in their global equity fund to just 21% in April from 43% a month earlier having now moved “underweight” the sector compared to its benchmark. After exiting its position in Google’s parent Alphabet this year, GQG has also sold shares in Meta, Microsoft and Amazon. Although the firm has cut its stake in Nvidia, the AI chipmaker and market darling is still the largest position in the global fund.

We can see the logic in GQG trimming its previously significant position in tech, but its forays into the defensive consumer staple and utility companies don’t sit quite as well with us, although we recently bought AGL Ltd (AGL) for our Active Growth Portfolio. Any such moves on the local market will require careful stock-by-stock analysis, as supermarkets, for example, have become a political football heading into next year’s election.

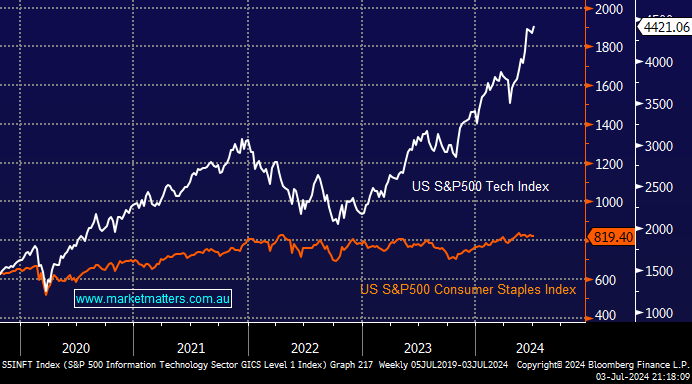

In the US, the story is slightly different. Staples stocks are trading at 52-week lows because they experienced multiple de-ratings. Investors have abandoned the need to pay for defensive stocks as the economy remains strong, i.e. the much-touted Goldilocks growth scenario with falling interest rates. At MM, we are huge fans of this style of dynamic rotation across portfolios, but where and when are always the million-dollar questions.

- We are looking for some performance reversion from the US Tech Sector as valuations stretch ever higher.

This morning, we’ve briefly updated our thoughts on some US names included in GQG’s rotation towards a more defensive stance, plus two major Australian tech stocks.