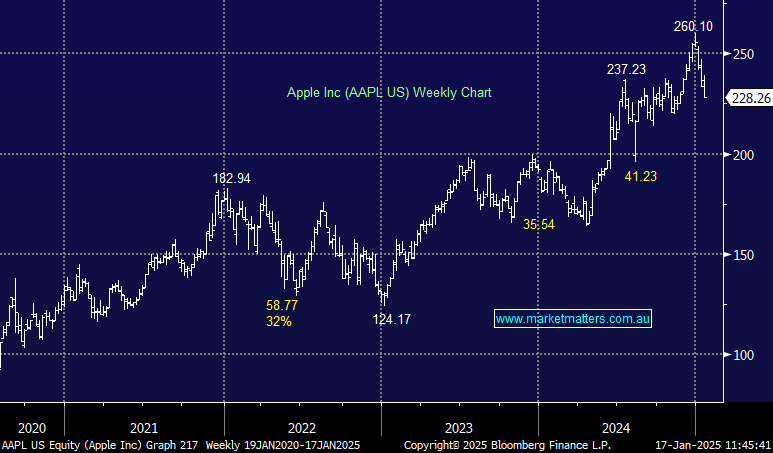

Apple has been in the portfolio since inception (26/06/2019), and is up 380% in that time frame. However, all good things come to an end; investing is about the future, not the past. The growth outlook for AAPL has weakened and we believe their current valuation is too rich for mid single digit top line growth in the coming years, which is our expectation. We are therefore selling our holding in Apple, switching funds into a deeper value opportunity in the Healthcare sector.

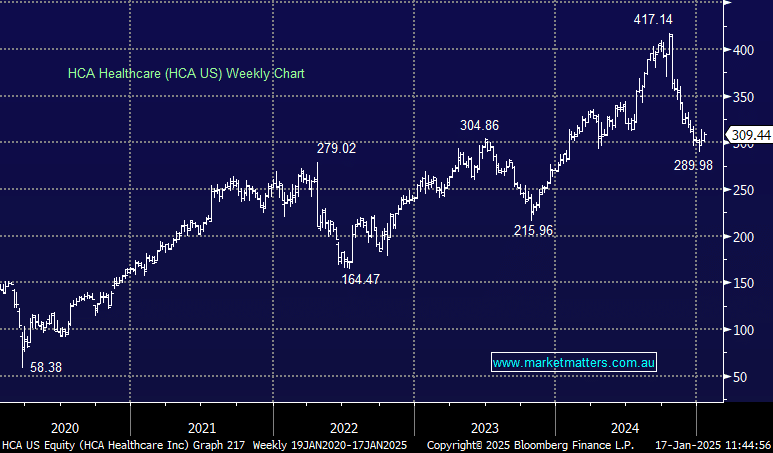

A company members should be familiar with is HCA Healthcare (HCA US), a large operator of hospitals and other care sites across the US & the UK. We have owned HCA on two separate occasions in recent years, only selling the stock in September of 2024 nearer $US400. The stock has pulled back and is now trading around 1 standard deviation ‘cheap’ – a level used to trigger our prior two portfolio buys. We expect ongoing earnings growth of 5-10% a year with the stock trading on 12.5x.