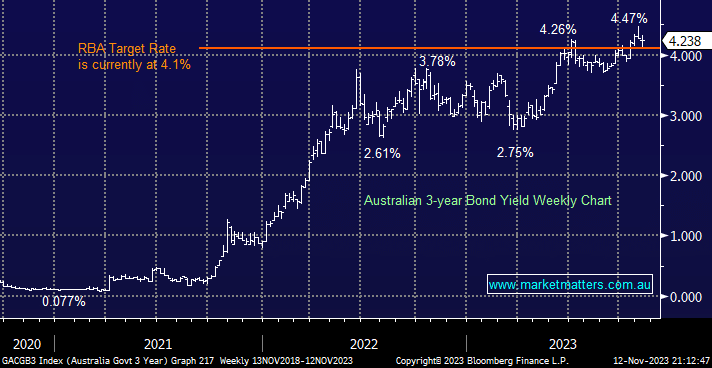

The Australian three-year bond yield chopped around last week in a fairly volatile manner following some conflicting messaging from various US Fed members; the end result was the short-dated local bond closed unchanged, still trading below the 4.35% cash rate.

- No change; we continue to look for Australian short-dated yields to eventually re-test 3% in 2024/5 but acknowledge such a move will require a move towards a more accommodative stance by central banks.

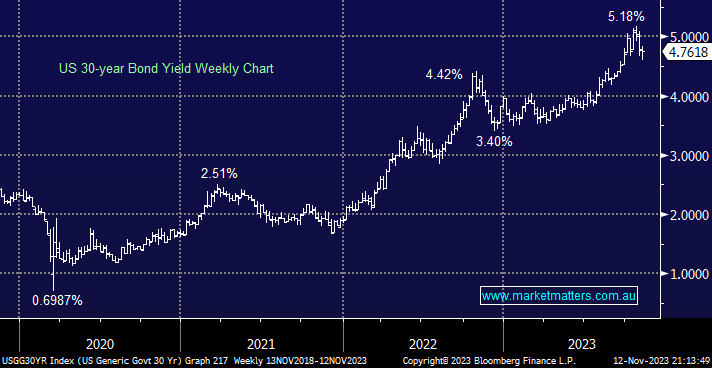

The US 30-years stabilised last week, and although Fed officials appeared more than happy to keep money markets second-guessing, at least we are finally seeing some more dovish comments creeping through.

- We continue to target a retest below 4.5% over the coming months – a similar pullback to that in late 2022 targets the 4.25% area.