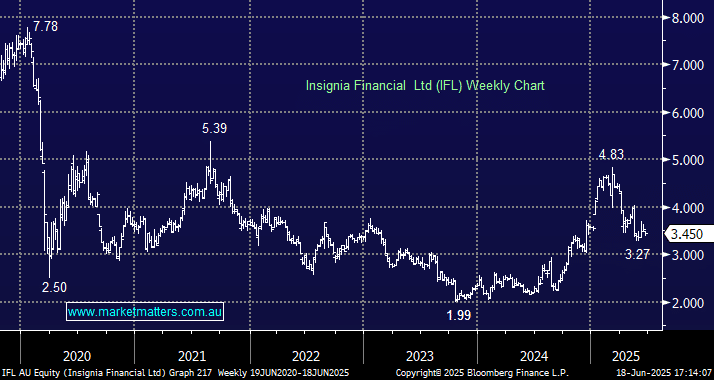

A bidding war was unfolding for IFL in early 2025 although you wouldn’t know it from the share price:

- Bain Capital launched the first bid in December 2024 at $4.00 per share (~$2.7 billion valuation), which was rejected by the IFL board.

- On January 6th, CC Capital Partners put forward a rival offer of $4.30 per share (~$2.87 billion), prompting intensified negotiations.

- Bain Capital matched CC Capital’s bid at $4.30 shortly after.

- On March 7th, both Bain Capital and CC Capital sweetened their proposals, offering $5.00 per share, and due diligence agreements were signed.

With the due diligence period now complete and Bain withdrawing from the process due to “macroeconomic uncertainty”, the market appears to have lost confidence that a deal will go ahead with the stock trading substantially below the $5 bid. Since the December bid, the ASX 200 has advanced by a few per cent, plus dividends, which adds to IFL’s earnings, with over 80% of its revenue coming from platforms, such as wraps, where revenue is linked to AUM. This is a rare stock on the main board that appears cheap, with some potential M&A upside added on top – at the very least, it should be a good proxy if MM proves correct, and the market rallies into Christmas.

- We like the risk/reward towards IFL below $3.50, basically where it was trading before the first bid.