Income portfolios have room for some exposure to more eclectic/riskier positions in the quest to add some measured alpha. Miners are one example, with Fortescue (FMG) forecast to yield 6% fully franked over the next 12 months, but this could vary tremendously depending on the price of iron ore. If we’re prepared to take exposure to bulk commodity prices, why not chickens? Chicken and turkey producer ING is forecast to pay a steady yield of around 6.5% fully franked over the coming years, assuming we have no more bird flu scares.

- One aspect of ING we like is that insiders have been solid net buyers over the last 12 months—we like stocks where management wants to increase their “skin in the game”.

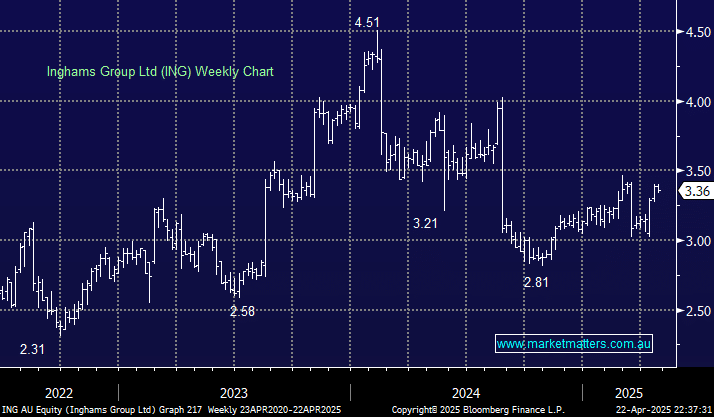

The stock enjoyed a noticeable April rally of around 10% on no specific news; potentially, fund managers have digested February’s earnings number further, where it delivered its second-highest first-half earnings since listing, with an underlying EBITDA of $124 million for 1H FY2025. Also, ING is likely to have benefited from being a business whose earnings are immune to tariffs. Plus, if we get more challenging economic times, ING providing one of the cheapest forms of protein should be a tailwind.

It’s been a volatile journey, but ING has outperformed the ASX over the last 3 years before we consider its healthy dividend. From a valuation perspective, ING is still trading more than 10% below its 5-year average, which we believe is not justified. This should afford investors a cushion moving forward, hence our initial target of ~$3.75.

- We like ING around $3.40, believing it can yield strongly and deliver capital growth for investors.